Normally, when we purchase products we are given the opportunity to make payments in installments, but is it possible to pay in installments in AliExpress?

The answer is yes, it is already possible to make installment payments from AliExpress itself, in addition to making the purchase with your credit card through your bank. Below, we tell you how to do it and what are the different methods.

PayLater: meet the virtual AliPay card with financing

Alipay is a payment system of AliExpress. Also known as the Chinese PayPal, Alipay is gaining popularity day by day, so much so that the launch of PayLater has recently been announced. PayLater is a private card, and its use is unique and exclusive to AliExpress.

You can obtain it through BBVA, and with it you will have multiple benefits:

- At the end of the month you can pay a single installment without interest.

- You are allowed to defer your purchases for up to 12 months.

- There are no issuance or maintenance fees.

- You can request the card online and you will get an automatic response.

You do not need to be a BBVA customer to use and apply for the virtual card.

Payments will be made by direct debit to the bank account you provide. This facilitates the application, in addition to allowing you to verify what you have consumed and your limit through the BBVA application.

How do you get the PayLater card?

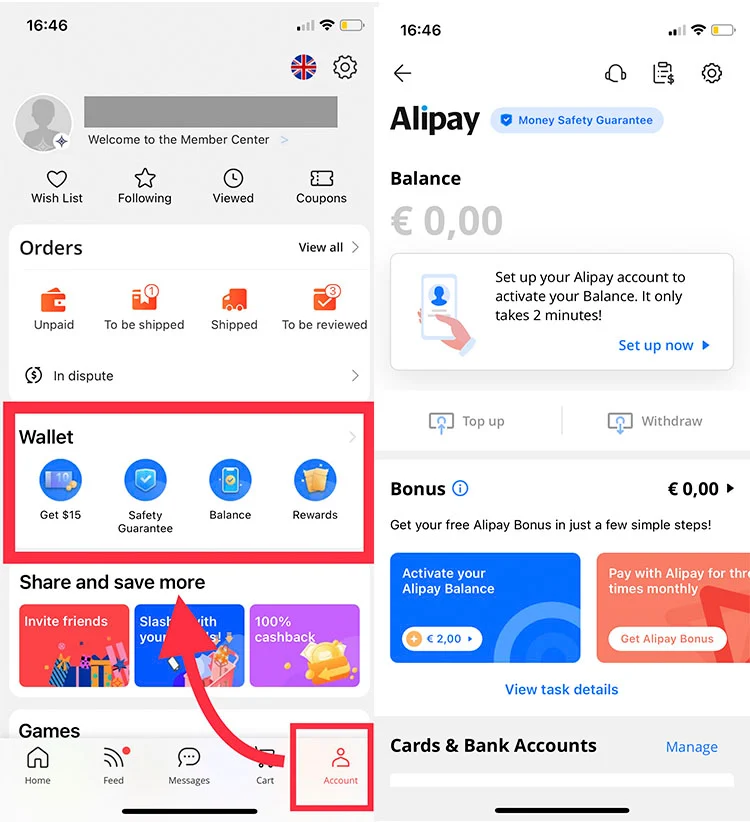

You can request PayLater virtual cards directly from your AliExpress account, both through the browser and through the application. You will only have to enter your account and click here or look for the AliPay section there You will find the PayLater option where you can make the request by clicking “Request”. The platform will redirect you to a BBVA form where you will be asked to enter some personal information such as name, telephone number, ID number and type of bank account.

The only restriction to apply for the PayLater virtual card is your age, as you must be over 18 years old. On the other hand, the limit of your virtual card can be between 75 and 600€ per month. You may be able to increase or reduce your credit, so please contact BBVA.

How do I use PayLater to pay in installments?

Once you have made the application for the PayLater virtual card and it is active, you only need to add the products you want to buy to your cart and choose PayLater as payment method.

Once you have selected PayLater as payment method you will be presented with the following options:

- Pay in a single installment.

- Finance the purchase in 3, 6, 9 or 12 months.

Please note that to finance a purchase the final amount must be less than 15 Euros. In addition, to pay a single installment there are no interest or minimum amounts.

If you are interested in knowing the settlement day, you should know that it is the 25th of each month, while it is charged on the 5th of the following month.

Frequently asked questions about PayLater

Below, we will answer the most frequently asked questions from customers who want or have already used PayLater virtual cards.

Can I use PayLater for all purchases?

You will be able to purchase any product with your PayLater virtual card, regardless of the amount or origin. However, please note that you will only be able to finance purchases of a minimum of 15 Euros.

Are there any interest charges when using PayLater?

The interest you pay is 18% per annum, i.e. APR 19.4%. To exemplify this, by purchasing some product of 600 Euros and doing one year financing, you will end up paying 658.19 Euros.

What happens if I do not pay an installment?

There are penalties for late payment, they are called late payment interest. Its value is 30 Euros, so on the 5th day of the following month the discount will not be made, but you will be charged this penalty.

How does it work in case of refunds or cancellations?

This is a situation that happens frequently, so if the refund has been made in the same month of the purchase, the money will not be discounted. If the refund is made after the settlement date, i.e. after the 25th of the month, the money will be issued as a credit memo at the end of the month.

If a partial repayment is made, the installments will be recalculated taking into account the amount of the repayment and the remaining months, but keeping the same initial interest time.

Can you cancel the PayLater card?

The answer is yes, you will be able to cancel the card either after the contract or at a later date, and in neither case will you be charged an additional cost.

How to contact your bank?

To consult or talk to your bank, we invite you to call BBVA customer service. The number is 900 108 592, and in that call you will be asked for your personal information in order to corroborate your data. If you prefer a less personal communication, you can do it through the BBVA application.

Finance purchases with Oney

Oney is also used to finance AliExpress purchases. This system has a presence in different online stores, and its objective is to offer financing to customers.

For Oney you will have the options to defer payments between 3 and 4 months with really low financing costs, as we present below:

- Payment in 3 months: APR 43.09% (about €3 every €100).

- Payment in 4 months: APR 37.34% (about €4 every €100).

Are there conditions to defer payments?

Yes, the following:

- Make a purchase between €50 and €2,500.

- Pay with a Visa or Mastercard credit or debit card.

- Prepaid, virtual, or American Express cards are not accepted.

- The card must have a validity date greater than the selected terms.

How to get financing?

To defer your payments, only purchases whose amounts are at least 50 Euros are required. Select Oney as the payment method, click on “Deferred payment with your card”, confirm your name, telephone number and email and choose the installments.

Comparison of PayLater and Oney

Below we will compare both payment methods, so you can decide which one suits you.

- Regarding interest, it is PayLater who has a lower one, since it is 18% TIN, compared to Oney’s, which is greater than 30%.

- PayLater’s minimum funding is €15, compared to €50 for Oney.

- With PayLater you can finance up to 12 months versus Oney’s 4 months.

- You can use Oney directly with your card, while to use PayLater you have to fill out an application. Following this line, Oney does not ask you for data, while with PayLater you must wait for your credit to be approved.

- The funding limit with Oney is €2,500 versus €600 with PayLater.

In conclusion, if you want to pay less and not finance more than 600 Euros, it is best to use PayLater, although with this card you will have to make a request offering your personal data to obtain financing authorization.

On the other hand, if you do not want to give your personal data and your purchases are over 50 Euros, the option for you will be Oney. As there are few requirements to obtain the card, the process is faster.

Other ways to seek financing

Having explained the above, we can conclude by saying that now making payments for your products is easier with these private virtual cards that are managed by BBVA. If you intend to make purchases whose price exceeds the limit of your card, you can contact your bank so that they allow you to finance the payments and increase your limit.

Another alternative to this is to get in touch with credit institutions that allow you to defer payments, although this is not our preferred option since the security they offer is inferior and, if you have difficulties with payments, you may have to pay more. money in fees and interest.