If you have thought about starting a business or if you already own one and want to give it a new perspective, surely it has crossed your mind how viable it is to buy on AliExpress to resell it in your country. It is totally true that you can find a variety of products at affordable prices on this online buying and selling platform.

How to get wholesale discounts

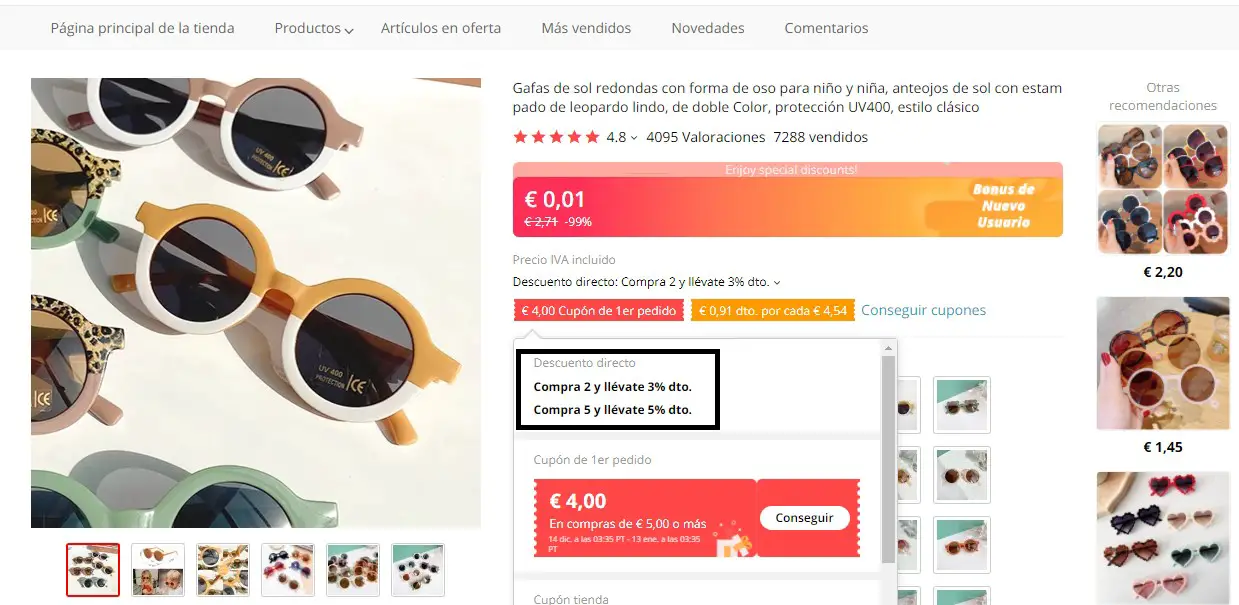

Depending on the number of products you order, AliExpress sellers have discounts for buying in bulk. These usually range from 1% to 5%.

Not all sellers give us this option in the first place, but there are cases where discounts can be seen in the product profile.

Quote prices from different vendors

You should keep in mind that most sellers who work on AliExpress are small merchants who resell items from other manufacturers, which indicates that the same product can be found in more than one seller.

We recommend that you look for the item that is of interest to you not only in one seller, but that you do it in several and, in turn, go looking at the prices, so that you can then know which one is the best for you.

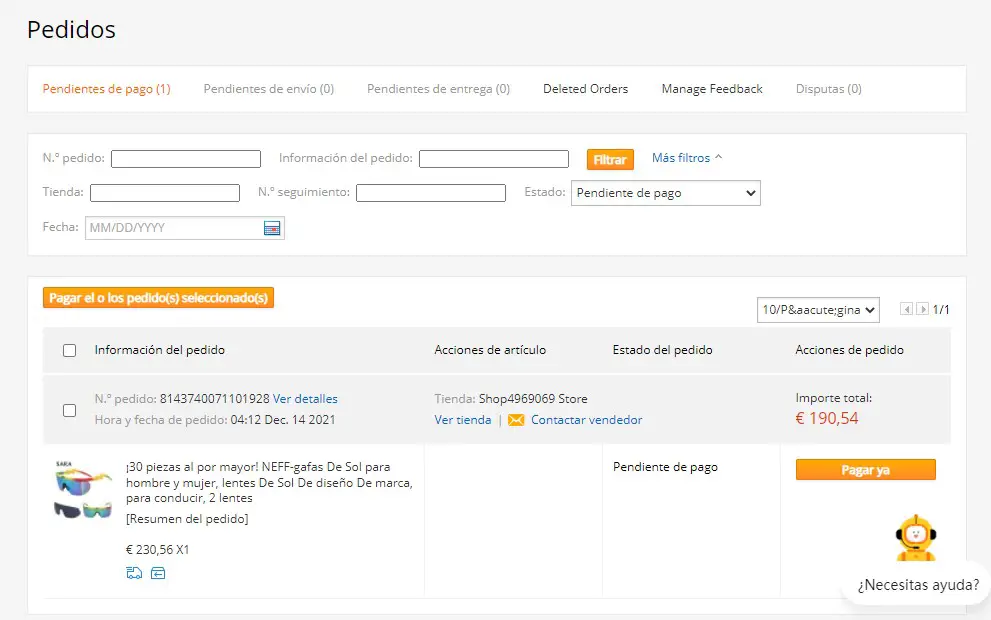

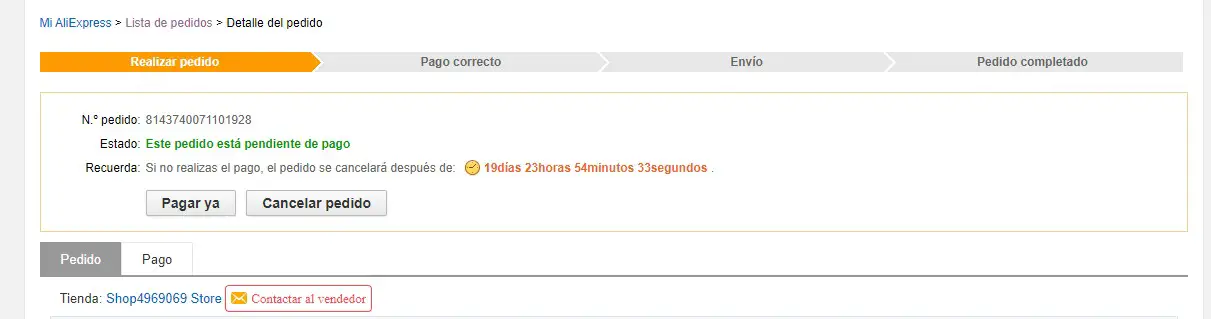

Generates a purchase order as a form of pressure

There is a way in which you can pressure the seller to get the best price and you can use this technique even if the product already has a direct discount. You will only have to include your purchase in the cart and select a payment method in which your bank details are not saved, such as PayPal for example.

Confirm the product in “pay now” and close the page or application, in this way you generate a purchase order without having paid anything. What you should do next is write to the seller to ask him to make you an offer if he wants you to finish the order. In this way, he will see that you are one step away from making the purchase and in order not to lose the sale, the probability that he will offer you a better price increases so that they can close the deal.

Talk to the seller

If the product you want to buy does not have any direct discount, we suggest you talk to the seller explaining that you want to buy the largest “x” amount and ask him to give you an attractive offer.

Costs and shipping time when we buy wholesale

You should not hesitate to negotiate the shipping cost if your order has it. With a little pressure, you can get it sent to you by express mail and even get it for free. It should be noted that if you want the negotiation to work, you must be aware of the number of products you buy: remember that buying 25 is not the same as buying 50.

What corresponds to the shipping time on AliExpress has improved a lot and with shipping methods such as “Standard Shipping” your order can arrive in up to 10 days, so it is much easier than before not to run out of stock.

In Latin countries (Chile, Colombia, Mexico…)

If shipments are not free in your place of origin, we recommend triangulating the logistics of your order to make it cheaper.

When we say that you triangulate the logistics, we mean that you can send your order to a mailbox in a country where it is free, and then send it to your country. An example is that you can send them first to Miami by sea and when they arrive they send it to your home.

Products prohibited to import

We advise you to review the import restrictions in force in your country, avoiding bad times, since if an item considered “prohibited” is detected, AliExpress will not be responsible for anything. An example of items not allowed are weapons.

Aliexpress Purchase Invoice How to download?

Now you can download directly without having to ask the seller for anything, you just have to go to “my orders”, then “see details” of the order you want and finally “download invoice”. Remember that it is important to download this document so that you can then deduct VAT from the purchase made.

What should I consider before importing?

To know the profitability of buying wholesale, there is something important that we must keep in mind and that is the taxes to be paid once the order arrives in our country.

Customs costs

There are three possible expenses throughout Europe, which are:

- Tariffs: only affects shipments over €150

- Customs management

- VAT: in a given case that it was not paid in the purchase, then 21% will have to be paid.

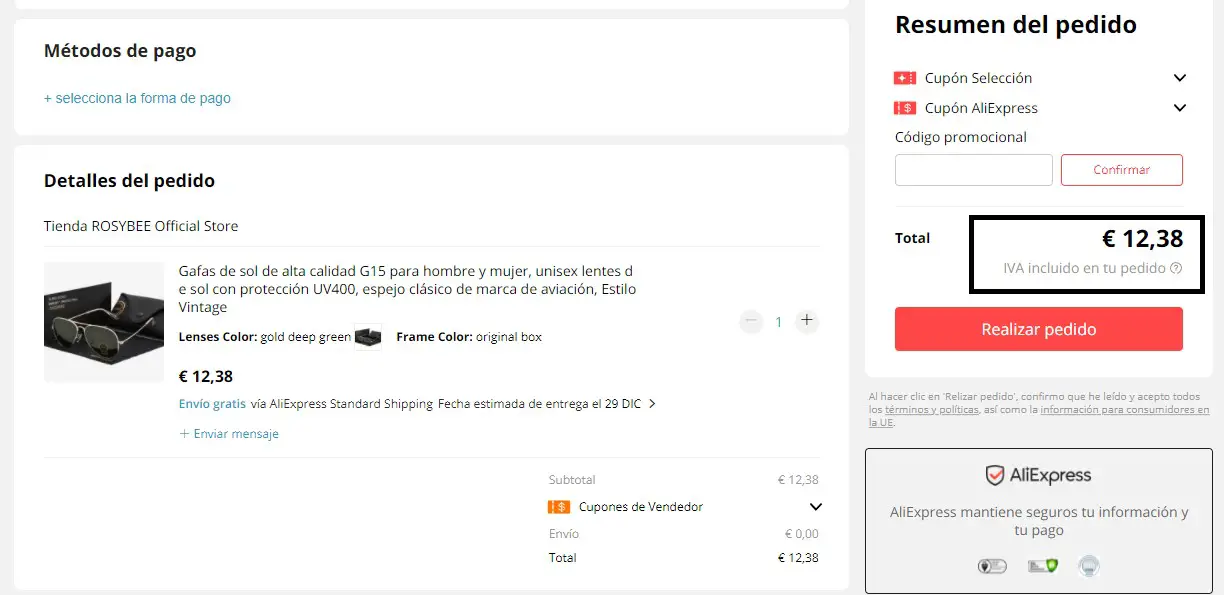

Orders with a cost of less than €150

In these cases, the tax that must be paid is VAT, which makes it possible to limit a very optimal change that AliExpress has made, and it is the inclusion of VAT in the invoice of those orders with a value of less than €150. . The product will arrive at your home without any inconvenience at customs and you will be able to download the invoice mentioned from the website or application.

However, on certain occasions, if the purchase exceeds €150 to €200, there is the possibility that VAT will be included.

Orders with a cost greater than €150

In these cases, the VAT tax is not included in the invoice, so you must pay it together with the tariff and processing costs when you arrive in the country.

The mechanism with these orders is the same as the one used previously, that is, you only pay if your order is stopped, with the difference that today the probability that your package is stopped is higher and increases much more if the package it is bulky.

We believe that you would be interested in having VAT covered on your invoice to have a little more peace of mind, so we suggest you separate the package into different orders of less than €150.

Documents I must have for an order over €150

In cases where the orders have a value higher than €150, a single administrative document or “DUA” must be presented. The courier company can do this for you automatically but will then charge the processing fees.

On the other hand, if you are a private person (not a legal entity), you can do what we call “self-management”, which is just fill out the “DUA” form yourself, including the papers that are requested, such as the invoice, for instance.

How to do self-management?

The steps are simple and we will show you below:

-

- Revoke the rights to post customs clearance, this in order that they cannot manage the “DUA” in your name and thus avoid adding costs that you must pay.

- You must register on the page of ADT postales and enter “I want to process my shipment through the AEAT”. Then, enter “generate self-management pre-notification”. They will give you a tracking number that you must constantly review, since once the order is in the country, it does not issue a notification, and if you do not self-manage, the post office will ignore the revocation and carry out the process.

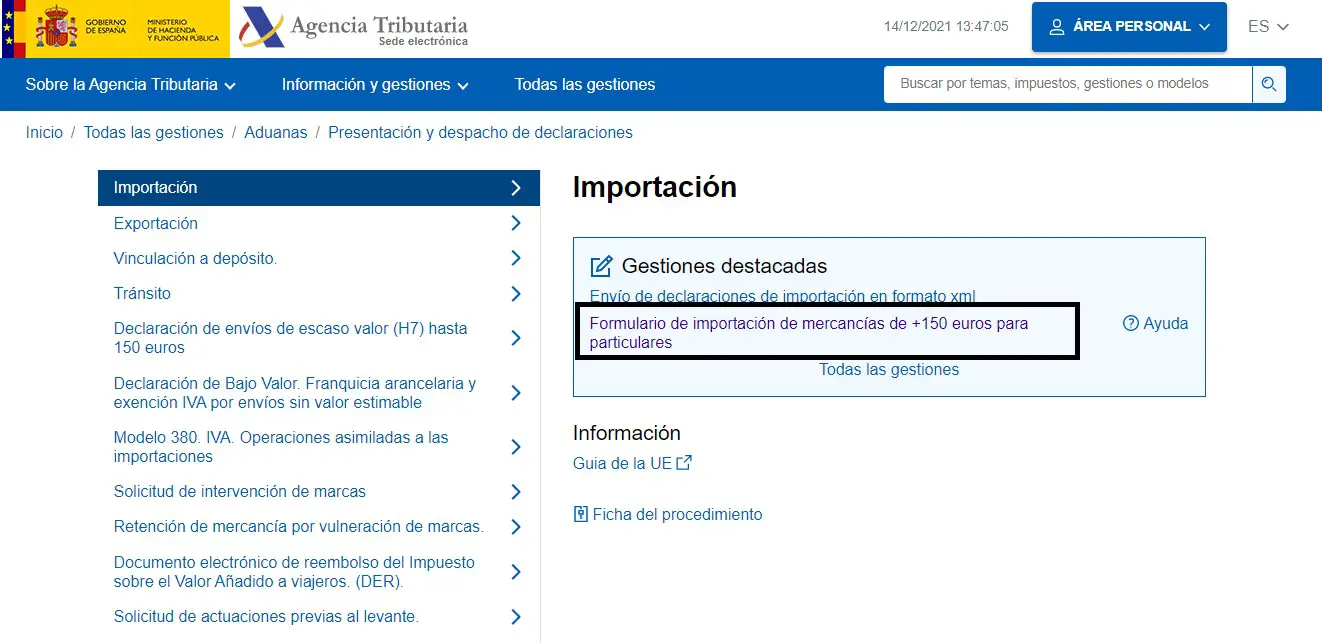

- Once the package is in your country, enter here and then in “Import form for goods of more than €150 for a private person”, to be able to fill in the DUA with the information of the purchase made on AliExpress.

Customs tariff: How is it calculated?

It is extremely important to know the percentage that you must cancel in tariffs. Thus, in the same way, you will have the knowledge about the profit margin that you can achieve with your purchase.

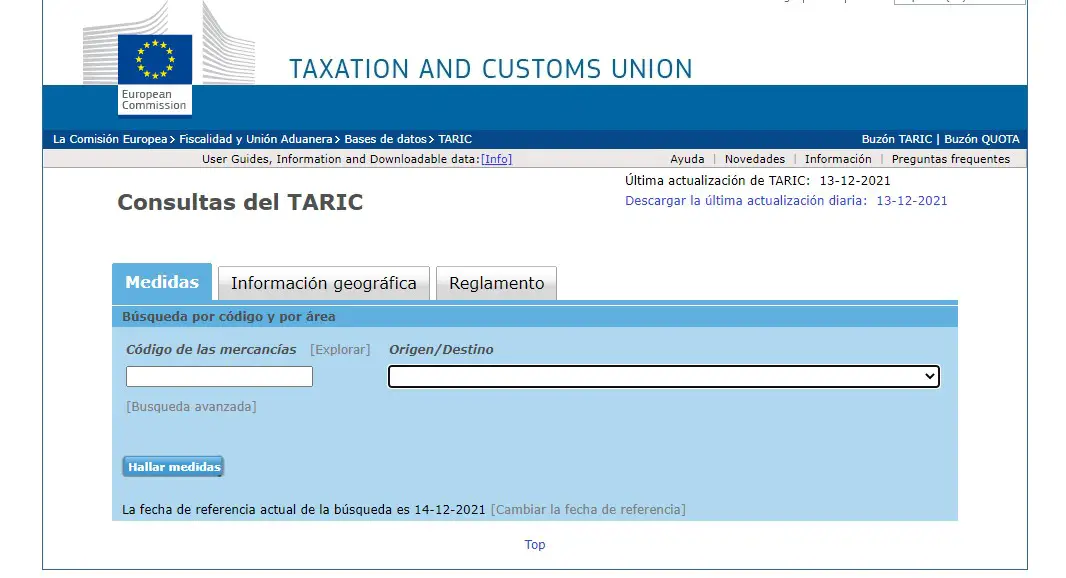

The import tariff from China to the European Union varies according to the type of product. Therefore, before making the calculation, it is important that you know the tariff code of your product. You can find this out by asking the seller directly or using an internet search engine.

To consult the tariff percentage you can enter here and enter the code. You must not forget to place China as the country of origin of the merchandise.

What happens if the self-management is not carried out?

As has been mentioned before, we remind you that not all orders are held to be reviewed by customs, but the chances of the package being detained are increased when the order is large.

If the self-management is not done and your package is not detained for inspection, you would be well off saving VAT and tariff expenses; but, if, on the contrary, the package is retained, what will happen is that the courier company will process the necessary administrative documentation on your behalf, which will end up being more expensive, since apart from taxes, you will have to pay the company’s charge for doing this management.

Deduct VAT as an expense

It is likely that, regardless of whether you buy as an individual or as a company, you will have much more benefits buying on AliExpress than buying in your country, even if you do not manage to do self-management.

In the quarterly VAT self-assessment form 303, you can deduct this tax from the purchase as an expense. However, it might surprise you that import costs are not as large as you think.

Buy wholesale in European stores

If you are in Europe, you could buy with shipping from a warehouse in the European Union, or alternatively AliExpress Plaza, saving you hassles regarding customs and tariffs.

Considering that AliExpress is increasing the number of items offered with shipments from Europe every day, this would be a very good option.

Ask the seller to separate the order into multiple packages

If your objective is still to save yourself the payment of taxes and tariffs, we suggest you negotiate with the seller so that your order is sent in different packages without exceeding €150. But you must be aware that you will have to evaluate and compare the cost of shipping, since it can be more expensive that way and by analyzing you will know if it is really convenient to do it that way.

Make wholesale purchases from Latin countries

In AliExpress, the way of buying and negotiating does not change depending on the country, but what does change is that since you are not in Spain, you will have to have all the possible information on imports.