Since the VAT reform that took place in July 2021, all orders from outside the European Union pay VAT and, in some cases, customs duties. For purchases under 150€, AliExpress already includes VAT in the prices, so you don’t have to manage anything or pay any additional amount to receive your order.

But, what happens with purchases over 150€? Is it true that customs holds all the packages above this value? Is there any way to avoid it?

Precisely, in today’s article we will answer these and other questions about it. We also tell you some tricks to avoid paying extra for your orders on AliExpress.

AliExpress does not charge VAT on orders over 150€

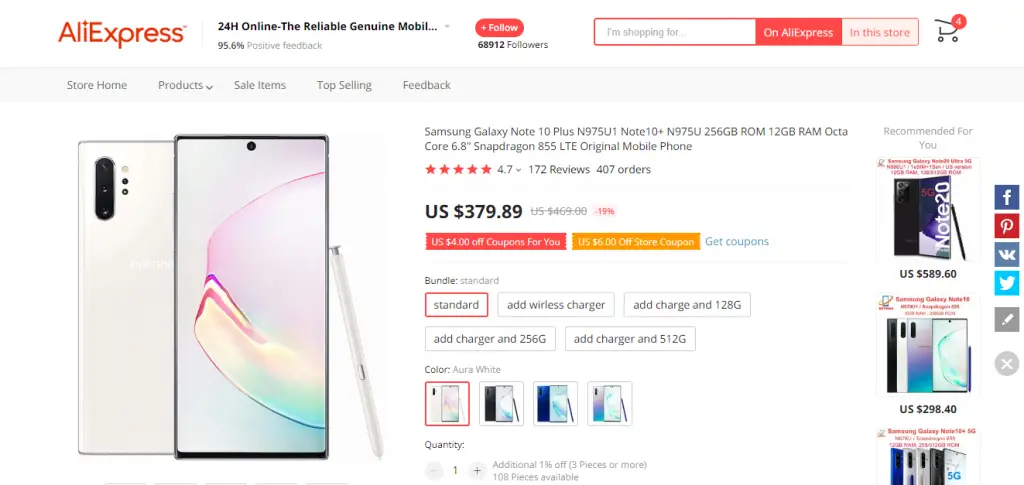

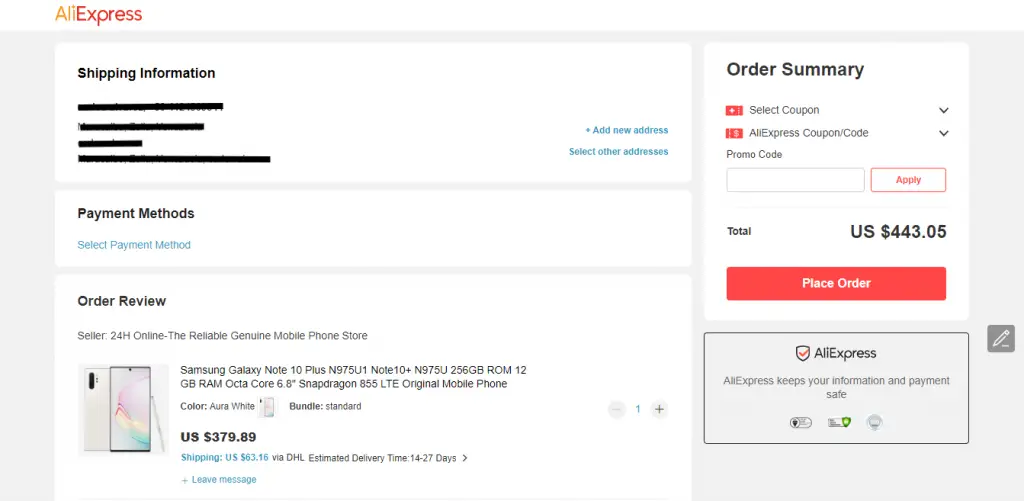

When you browse the AliExpress website, you will see that all prices appear with VAT included. You can check this by adding an item over €150 with shipping from China to your shopping cart. Here you will notice that, automatically, VAT will be deducted from the amount with the price adjustment.

In no way does this mean that the products are cheaper than buying them from a European warehouse. If AliExpress charges you VAT, it is so that customs does not charge it later. In case they don’t charge it, they will be able to claim it back later.

However, this is not always the case.

Is it possible for my purchase of more than 150€ to pass through customs without paying taxes?

Before the reform, it used to happen frequently that any package over 150€ would pass through customs without being checked, because of the huge amount of orders coming from China.

As there is a significant volume of import packages every day, customs controls often collapse and some orders pass through without being checked.

On items coming from the USA, for example, even some time before the VAT reform, it was very likely that customs would demand payment of taxes, as the volume of purchases arriving from this country is much lower than from China.

What happened after the VAT reform

After the VAT reform there was a period of much confusion among users of AliExpress and other Asian platforms, due to bad experiences: first AliExpress charged VAT and then the courier company pretended to charge it again. There were also abusive charges for customs handling fees, among other situations.

Over time, everything was clarified and these complaints were less and less, so people were encouraged little by little to buy again.

Yes you can avoid these taxes

Many of our readers ask us if it is possible for an order of more than 150€ to pass customs control without being claimed to pay VAT and duties.

The answer is yes, it is possible, it even happens right now, but you should keep in mind that it can always happen that they claim the payment of VAT and duties, plus the costs for the management of the process.

If you are willing to wait, you will not be able to do the self-dispatch yourself.

In our blog you will find an article in which we explain how you can do the self-dispatch yourself and thus save on expenses. However, you should keep in mind that if you decide to wait to see if they claim you or not, you will no longer be able to manage the self-dispatch, in case they ask you to pay duties.

How do I avoid being claimed by customs for the payment of taxes?

Now we tell you some tricks so you can save on your purchases of more than 150€.

Shop with shipping from a warehouse in Europe

If you are thinking of placing an order of more than 150€ with shipping from Europe, AliExpress will charge you VAT at checkout.

Given the situation, you will not be able to save on this tax but you will avoid customs fees, since your order is within the territory of the European Union and is not considered an import.

The vast majority of AliExpress sellers offering high-priced products have them available in European warehouses to expedite sales and spare buyers unwanted paperwork.

Filter your searches with shipping from Europe

To make it easier to search for the product you want to buy and you will only find those that have shipping from Europe, filter the result by clicking on “Filter” and select one of the countries of the European Union that has AliExpress warehouse.

If your seller has available shipping from China and Europe, negotiate with him

It may happen that the product you are interested in has shipping from China and from a warehouse in the European Union.

In this case, contact the seller and negotiate to see if he will allow you to make the purchase with shipping from China but then send it to you from a warehouse in Europe. This will save you VAT, duties and customs handling fees, in case you do not do the self-dispatch.

It is possible that the seller does not agree, but if it is a valuable product, he will accept in order not to lose a good sale.

For multiple item purchases, split the order into several packages

If you plan to buy several products of more than 150€ from the same seller, it is recommended that you divide the purchase into different orders.

To do this, separate the purchase into several packages and make different payments, so that AliExpress will charge you the VAT, but you will save on duties and handling fees.

Keep in mind that it will not serve you to pay all together and then ask the seller to separate the order into different packages, since AliExpress did not charge you the VAT and you will be exposed to claim it back.

Is exactly 150€ the limit up to which AliExpress charges VAT?

As we already said, when browsing the AliExpress mobile app or website, all item prices have VAT already included and, in case you exceed £150, it will be deducted when you finalize the purchase.

Don’t forget that the limit of 150€ is without VAT, that is to say, when you browse, keep in mind that all items over 181,50€ (150€ plus 21% VAT) are the ones that will pay VAT directly.

If you have any doubts about this issue, do not worry because you will always see the final price reflected at the end of the purchase.