Invoices are the proof of your payment, and day by day more and more users ask for their invoices at checkout. AliExpress is no exception, in case you ask the seller for an invoice and don’t get a favorable answer, we recommend you to go to customer service (you can find the contact here), as they’ll help you resolve your issue.

AliExpress is a Chinese company, and we all know how cheap it can be to buy products from this country. However, the countries’ customs are increasing their vigilance with the intention of getting more revenue.

One way to avoid problems with customs is to have in hand the invoice for the products purchased. Additionally, you can get these products from the warehouses where AliExpress is present in different countries such as Spain, France, Russia, Brazil, and the United States.

VAT and AliExpress: Who pays it, and how is it applied?

In AliExpress, VAT isn’t included in the price of the products purchased, as in other international stores. This is because exports from China and any other country are always declared without the inclusion of VAT.

Therefore, it’ll be the buyer who’ll assume the VAT price of the product whenever the country’s regulations require it.

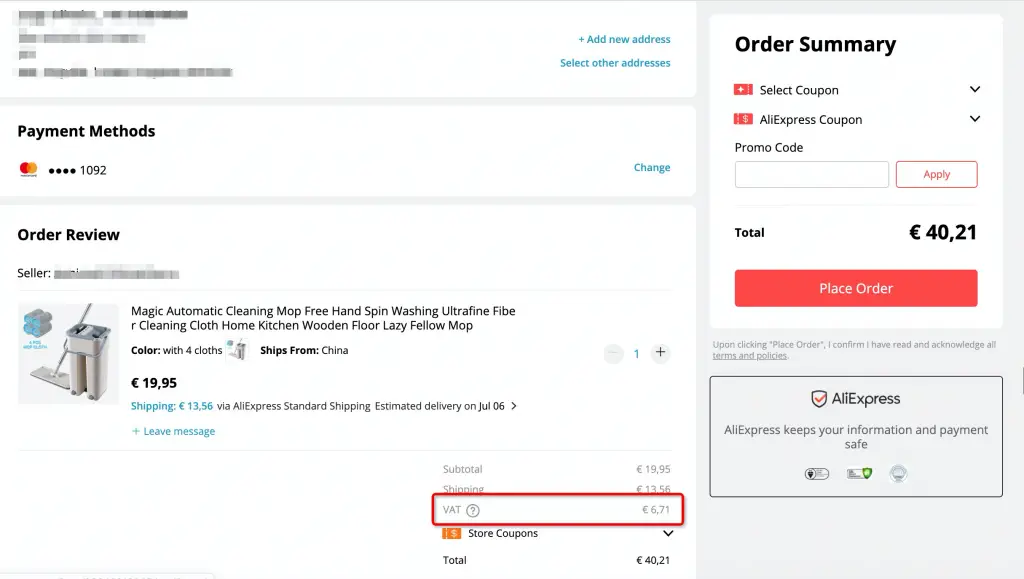

However, there are certain countries in which VAT must be paid before shipping the product, examples are some European countries. In this case, AliExpress calculates the VAT and charges it before placing the order.

How can I request an invoice on AliExpress?

The big online commerce platforms charge VAT when the user is European and the amount is less than €150. It’s convenient to download the invoice to have proof of payment in case of any possible problem. We’ll only have to access the list of orders and look for the option “Download invoice”.

To download the invoice, you’ll have to contact the seller, since they’re the only ones authorized to generate it. However, keep in mind that they’re not always necessary and that sometimes it’s enough with a screenshot that proves the payment.

The invoice will include the address where the product was shipped, Alibaba data, the name of the store, and the invoice number, as well as other information.

When we place an order that exceeds €150, we’ll see that the VAT won’t be included in the final price and that we won’t be able to request the invoice from AliExpress. In these cases, we’ll have to present the necessary documents at customs and contact the seller to give us the invoice.

You can learn more about this with our article on customs handling.

What if I can’t download the invoice?

In some cases, it’ll be difficult for you to download the invoice, such as when you buy from a non-European country or, as mentioned above if you’ve bought something over €150. In this case, and as we also mentioned before, it’s the seller who you should talk to provide you with the invoice, as indicated in this link.

If you don’t know how to do this, we recommend you to go through our article where we explain how to contact AliExpress sellers.

If you need the invoice to present it to customs, you should know that sometimes you won’t need it and that a screenshot or other document that proves the amount of the order and that it was you who placed it will suffice.

Are the invoices in the name of AliExpress?

As the invoice will be generated by the seller, you’ll only be able to download the invoice directly from the site when the VAT is included in the total price of the order.

The seller does not provide me with the invoice, can I get it from customs?

We’ve already mentioned that you can submit a screenshot verifying your order and the amount of your order to customs, along with a proof of payment transaction of your purchase on AliExpress.

If you still need the invoice, you can use applications that allow you to make an invoice by entering the purchase data. But be careful, because you’ll be giving personal data to third-party applications that can use them, and you could even be scammed.

How do I know if the invoice sent to me is complete?

For an invoice to be considered complete, it must have the invoice number, the total amount (including shipping), the seller’s information, the date the invoice was issued, a description of the purchase, VAT, or taxes (which will be 0 unless they were paid when the order was placed) and a tracking number.

Is the seller obliged to send me the invoice?

It’s possible that the seller doesn’t want to give us an invoice and instead wants to give us a purchase receipt, as it tends to happen when we buy in some physical stores. Still, more sellers are currently providing it to expedite the procedures with customs.

The use of purchase tickets is very common in products shipped from China, since, as in the case of AliExpress, there are other large platforms that group thousands of sellers who send very cheap products to various parts of the world.

Is the invoicing the same if I make purchases professionally?

If you have a business, and you’re going to buy merchandise to resell, we recommend talking to the seller before buying, to ask if they’ll invoice you.

We know that AliExpress seems the ideal option to get cheap products and fill your store’s stock. We even have a complete guide on dropshipping on AliExpress, where you’ll find tips to run your business, and we also leave you recommendations on the best way to buy wholesale on AliExpress.