In a reform carried out on July 1st, the obligation to pay VAT on all purchases made outside the European Union, regardless of their value, is expressed. If the order exceeds €150, customs duties must also be added.

This situation has put courier companies in a tight spot, which they are trying to solve through abusive measures, such as charging customs handling fees to customers.

However, have you considered that you can save yourself this expense in customs clearance by doing the self-clearance yourself?

When should you do the self-clearance?

First of all, you must be clear that in AliExpress, as in many other stores, VAT is already charged for orders under 150€, so you don’t have to worry about this procedure or pay anything else to purchase your order.

We proceed to explain the process with which you can make the self-dispatch in several of the most important courier companies.

Even so, you must remember that this will apply for those items over 150€, as well as for other online platforms that do not include VAT in their orders outside the European Union.

Can I not self-checkout?

You can do the self-clearance at will or simply do nothing, surrendering your trust to the fact that they do not stop the package at customs.

However, if it is detained and you did not make the procedure, you should know that you will not be able to do the self-clearance at that time, which will cause that you will not be able to avoid paying the handling fees.

How do you self-clear for Correos (ADT Postales)?

If you are a regular AliExpress shopper, you may have already noticed that most orders are handled by Correos.

ADT Postales refers only to the name of the website with which Correos can interact with buyers in order to communicate customs clearance procedures to us.

The exception: orders of less than 150€.

Important: this section only applies to those stores where you have not been charged VAT from the beginning.

Initially, you must revoke the customs clearance of Correos. This is essential, since it allows Correos not to do all the paperwork for you and, in this way, not to increase your expenses due to the charges related to the customs formalities.

The moment you can start the revocation procedure is when the seller sends your order. To do so, you only need to register on the ADT Postales website (you can do it here) and click on “I want to process my shipment through AEAT” and then on “Generate self-dispatch PREAVISO”.

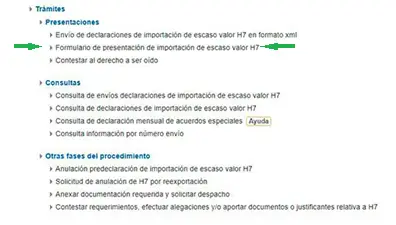

Here you will find two ways to perform the self-dispatch for those items under 150€:

- Using form H7.

- By paying VAT directly on the ADT Postales website.

Through form H7

It is a declaration that is valid for orders with a value of less than 150€, which you can do through H7 (more information in this link). You will be able to do the procedure from the moment the seller sends your order, this can be by means of your electronic ID, certificate or PIN code. Click on “H7 low value information submission form” to open the document.

It is important for you to know that in order to fill in the H7 form you must have the purchase invoice at hand and take into account the following considerations:

- Attach first in “Attachments: Add file” your invoice or proof of purchase and write in the description the reference of the document.

- Number of items: select the number of items in your package (and how many different goods it contains).

- Shipping number: Indicates the tracking number given to you by the seller.

- Gross mass: put the weight of the package (it can be approximate).

- Representation character: choose “Self-dispatch”.

- Exporter: Fill in the data of the exporter that should appear on the purchase invoice. If you are not sure, just filling in the boxes with something is enough for them to accept it.

- Importer and Declarant: You must fill in both sections with your data.

- Support document: Choose the type of document you provide (the invoice or proof of payment you have) and write the reference number you indicated when attaching it.

- Transport cost to destination: indicates the currency and the amount that appears on the invoice for shipping costs (if any).

- Additional procedure: select “Excess low value shipments”.

- Item 0001: if your package only has one item (a single merchandise), fill in item 0001 with the order data: value, description of the merchandise, merchandise code, VAT applied, units supplementary (leave this space unfilled).

You can check the commodity code directly here.

If you have more items, you must continue with the next item in section 0002, and so on. After filling in the form, you must confirm the data and click on “Sign and send”.

This leaves only the last step to be completed: the payment of VAT. However, you should check that the “Document summary” tab shows “Circuit: green channel”.

If “orange channel” appears, it means that the documentation provided will be reviewed and you must wait for the status to change to “green channel” before you can pay.

The Tax Agency will send you an e-mail with the Secure Verification Code (CSV), which you have to enter through this link, to download your H7 document and send it to Correos from here.

This is extremely important, as it will allow you to know that you should not be charged anything when the order is delivered to you.

Paying the VAT directly on the ADT postal site

Another simpler and faster way for orders with a value of less than 150 (and which so far remains free of charge) is by paying VAT directly on the ADT postal page (enter here).

To do this, enter the tracking number of your order, so you can view the option to pay VAT from this page when the order arrives in the country.

You should know that you may not see the option to pay VAT. This is because your purchase has not yet arrived in your country.

For orders over 150€

For those orders with a value over 150€, you will have to pay VAT and duties by filling in the DUA (Documento Único Administrativo) form.

First, as explained above, you must make the customs clearance revocation here, on the ADT Postales page. In the case of items with a price over 150€, it will be essential to complete this step so that Correos does not do all the paperwork for you, making you pay the handling fees that will allow them to deliver your order.

ADT Postales will give you a tracking number of your package, which will allow you to make the self-dispatch in 3 or 4 days. You must pay close attention to this number, because if you do not do the procedure within the term, Correos will skip the revocation and will execute it for you.

If your order is already in Spain, do the self-dispatch by completing the Tax Agency’s DUA form here and clicking on “Import form for goods of +150€ for individuals”.

You must remember that you will need an electronic accreditation such as an electronic ID card, digital certificate or PIN code.

Information to be taken into account when filling in the DUA at the AEAT (Spanish Tax Agency)

- 22. Currency: code of the currency with which the purchase was made.

- 33. Merchandise code: Leave the code that appears by default to apply 21% VAT and 2.5% tariffs. You can search for the merchandise code by clicking on “?”.

- 36. Preference: leave default.

- 40. Reference number: indicates the shipment number with which you have tracked the order. If you get an error, the package may not have arrived in Spain yet or you may not have submitted the revocation to make the self-dispatch.

- 42. Purchase value: in the currency you have indicated.

- 44. Invoice number: or some reference that appears on the proof of purchase (fill in all the boxes with 44).

- Issuer/Exporter: these are the seller’s details that appear on the invoice.

- In “Country” you have to put the code of the country from which it is sent. In “?” you can check the code.

Then you will need to attach the documentation to justify the value of the purchase. Click on “Add file” and upload the invoice.

Review the data and click on “Sign and send”.

When the “Admission” tab shows “Circuit: green channel”, you can proceed. If you see “orange channel”, it means that the documentation provided will be reviewed and you will have to wait for it to change to “green channel” before you can pay.

Download the payment receipt to send it to Correos (from this link) and have your order delivered without any additional charge.

Self-dispatch for DHL

In the case of DHL or other private courier, the procedure will be similar to the above.

For orders under 150€

As soon as you have the tracking number, send a request by e-mail to the company with your data and ID, requesting that the H7 form for the shipment with the assigned tracking number is not processed in your name before the Tax Agency, since you are going to perform the self-dispatch yourself. Make it clear that you do not require the services of documentary assignment, nor any other associated with customs, and that you are not going to pay for any of their management.

The following steps are the same as we have explained before for Correos, but note that in the “shipment number” section, you have to put a zero in front of it.

For orders over 150€

When they send your order, contact by e-mail with the company and give them your data and ID, prohibiting the DUA to be processed in your name before the Tax Agency, indicating the tracking number and stating that you yourself are going to process the self-dispatch before the AEAT. As before, make it clear that you dispense with the documentary assignment services, and that you will not pay the customs handling fee.

Complete the DUA as we have seen in the Correos section, but add a zero in front of the “reference number” (order tracking number).

Send a receipt of the H7 or the DUA

Send the receipt of the H7 or the DUA (import release) to this address: [email protected], so that it is recorded that you do not have to pay anything to get your order delivered.

It is possible that after sending this e-mail you will receive an automatic e-mail warning you that you have to pay a handling fee. If this is the case, reply that if they try to charge you for something that you have not contracted, you will file a claim with the Tax Agency and the consumer’s office.